ENDOWMENT MANAGEMENT THE WESLEYAN WAY

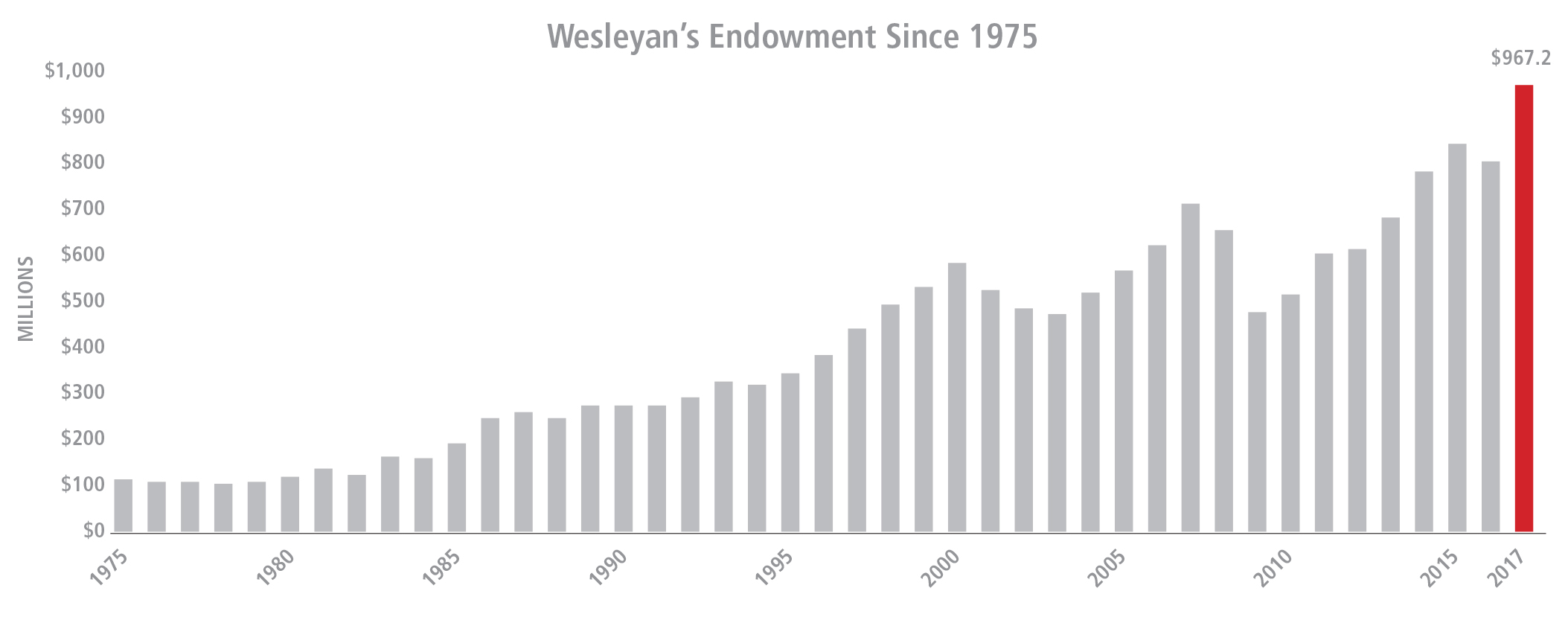

In 1866 Wesleyan established the Permanent Fund, also known as the endowment, with $93,153 in pledges and gifts. The word “permanent” implied confidence and a forward-looking mentality. Wesleyan’s leaders then would surely be pleased to know that the endowment has delivered on its promise to be an enduring bedrock of financial security, managed to help assure that generations to come will benefit from a Wesleyan education.

Fast forward to the present. The endowment contributes 18 percent of Wesleyan’s operating budget—over $38.8 million in 2018, supporting every aspect of university operations and particularly financial aid. Without the endowment, it’s hard to imagine how Wesleyan could occupy its position as a leader in liberal arts education.

“All of our educational aspirations rest on the need for a sustainable economic model supported by a healthy endowment,” says President Michael S. Roth. “Wesleyan has made enormous progress in securing its economic foundation, and endowment management has been absolutely critical to this success. As a result, we’re able to make careful investments in the academic enterprise and do more to support our students in every aspect of their lives here.”

Excellent endowment management also sends a strong signal to Wesleyan’s constituencies and reassures donors that their investment in Wesleyan will be overseen prudently, with long-term objectives in mind.

One cannot talk credibly about the endowment without acknowledging its history. In the 1960s, Wesleyan’s ratio of endowment per student was nearly unmatched. Many years of overspending, inadequate fundraising, and the high inflation of the 1970s seriously eroded that position, to the extent that the university now lags its peers on that measure and is unlikely to catch up anytime soon.

In recent years, however, Wesleyan’s endowment management and fundraising have been strong. Wesleyan now competes well with peers in fundraising and concluded the THIS IS WHY campaign with $482 million raised—by far the most successful fundraising campaign in the university’s history. Support for the endowment was a major goal of the campaign, and there is one telling measure of that success: From 2010 through 2017, gifts added nearly $190 million to the endowment in principal and another $63 million in capital gains on the principal. Gifts from alumni and others, along with rising capital markets, have substantially accelerated growth of the endowment.

From a nadir of less than $500 million following the financial crash in 2008–09, the total value of Wesleyan’s endowment in 2018 crossed the $1 billion mark. Although that seems like a milestone—and has produced some restrained celebration—long-term positive trends and other changes are much more important.

Leadership Matters

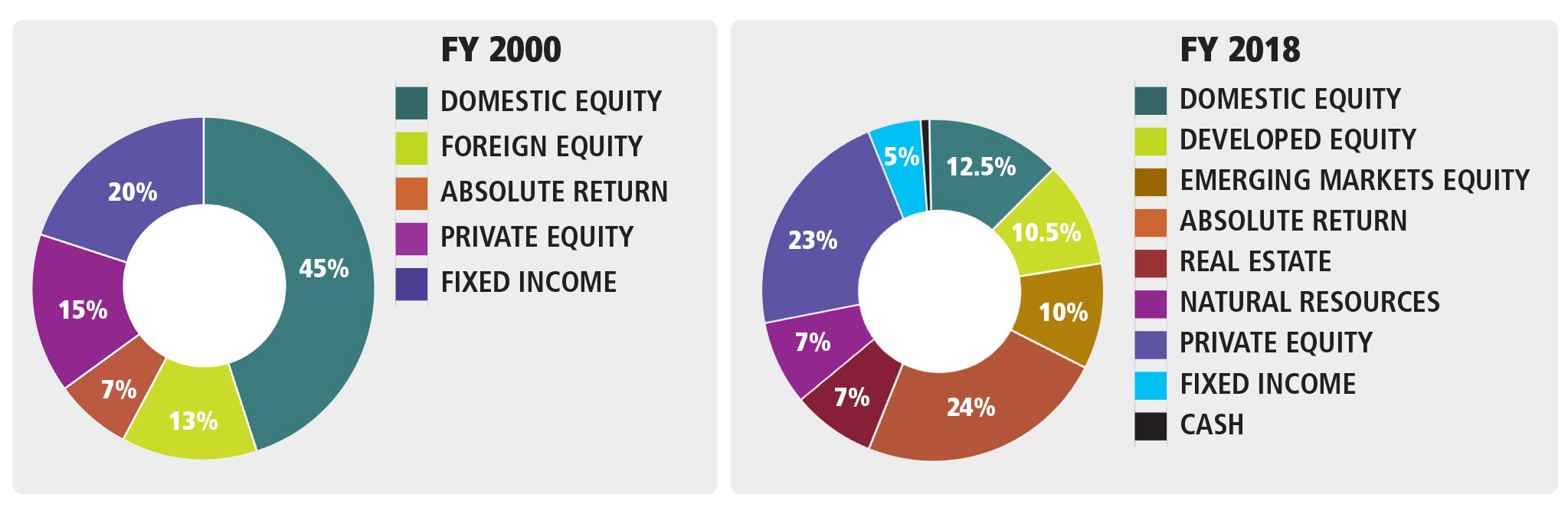

Anne Martin became Wesleyan’s chief investment officer in 2010, having previously worked as a director in Yale’s storied investment office, led by former Wesleyan trustee David Swensen. She and the Board of Trustees restructured the governance of investment operations in 2011, creating an Investment Committee that reports directly to the board and sets policy. The committee has stressed important concepts such as diversification, equity orientation, and a high degree of care in managing and monitoring the investment portfolio, as well as assuring that investment processes conform to Wesleyan’s policy on ethical investing.

The following year, the board and administration made another important change by rewriting the spending rule, which dictates how to calculate the annual payout to the university from the endowment.

“The main concept is that we shouldn’t overspend to benefit the students of today over future students, nor should we underspend to benefit future students,” Martin says.

The payout calculation follows the Tobin Rule (named for Nobel Laureate James Tobin), and the key variable is the spending rate. The board determined that a sustainable spending rate for Wesleyan is 4.5 percent. Martin points out that small adjustments to the spending rate can have a dramatic impact, over time, on the endowment’s purchasing power and ability to weather market volatility. In the past, Wesleyan spent more freely from the endowment, and the new spending rule was designed to curb those tendencies.

Day-to-day management of the endowment falls to Martin and her staff. Evaluating and monitoring dozens of managers—whose expertise ranges from U.S. equities and fixed income to real assets, emerging markets, and private equity—is their most important task.

“The process is a bit like dating,” she says. “We prefer to get to know new managers over an extended period of time so we can observe how they operate through different market conditions. We look for a number of characteristics: high integrity, an independent mindset, and great investment judgment.”

“We’ve selected a number of new managers who we would rank among the best in the world,” Martin says, “and we’ve put in place a plan to add to and manage our illiquid asset portfolio where we think we can achieve long-term rates of return that are above those offered by public markets.”

Wesleyan’s total return on endowment investments has averaged 8.8 percent per year in the five years ending in June 2017, exceeding all benchmarks for that period. Martin works with the Investment Committee to achieve those results while managing risks; it’s not possible to outperform benchmarks without accepting some degree of risk. She frequently stresses the importance of mitigating those risks through careful attention to asset allocation and manager selection. And she always stresses the importance of avoiding permanent loss of capital—by which she means not the ups and downs of the market, but losses from ill-conceived investments that go south and never recover.

Gifts Make All the Difference

Martin stresses that the role of gifts in achieving financial objectives cannot be overstated: “Without gifts, support for Wesleyan’s academic program and financial aid today would be vastly diminished.”

If the university had received no gifts since 2010, the endowment would be $740 million rather than $1 billion and the payout would be $10 million less annually. Over a longer period of time, lack of gifts would result in a much larger diminishment in university resources. That would translate into fewer faculty, larger classes, and less financial aid—in short, a different Wesleyan than the one we want.

Fortunately, Wesleyan does not have a shortage of generous alumni, parents, and friends, as the THIS IS WHY campaign revealed so clearly.

“One of the big changes we made at the outset of that campaign,” says Barbara-Jan Wilson, vice president for university relations, “was to direct larger gifts into the endowment and limit the amount we would use as direct support of the operating budget through the annual fund. We recognized that Wesleyan’s future depends heavily on building a stronger endowment.”

That’s fine for large gifts, but what about $25 from a young alumnus making a contribution to the annual fund. Does it matter? The answer is an emphatic yes because, much like voting, small individual actions become very significant in aggregate. The thousands of gifts to the annual fund contribute a whopping $10 million in aggregate to the budget.

“We can’t say often enough that every gift is meaningful,” Wilson notes. “Gifts to the annual fund directly benefit today’s students, and they protect the endowment because we don’t have to increase the spending rate to balance the budget. They make the Wesleyan experience better for all our students today and tomorrow.”

A sophisticated approach to endowment management has produced excellent results in recent years, but Wesleyan’s aspirations require continued progress. For instance, nothing is more important to the university than its ability to attract a diverse student body with sufficient financial aid. Today, there is still a $20+million gap between the endowment payout and the $60 million cost of financial aid to Wesleyan in uncollected revenue.

A larger endowment could eliminate that gap and put Wesleyan on firmer footing in its ability to offer competitive financial aid packages. Donor support remains critical to achieving this goal.

A Disciplined Approach

Martin believes in a disciplined approach devoid of hubris, and in this she is backed by an Investment Committee whose members think long term and will keep a steady hand during the occasional large market corrections that are bound to occur. The committee meets four times a year and plays an important role in setting strategy and policy. Members pay careful attention to risk metrics and they provide feedback on staff processes.

“The committee approves all new managers we invest with,” says Martin, “and by doing so, they provide important oversight. Members are also a source of interesting ideas or due diligence checks.”

David Resnick ’81, P’13, Wesleyan trustee and recently retired president of Third Avenue Management in New York, chairs the Investment Committee and explains that the committee does not invest Wesleyan’s portfolio—that’s the job of the Investment Office—but does look at strategic issues such as asset allocation and liquidity (meaning can the endowment meet its payout obligations to Wesleyan in the event of a market crisis). The committee’s focus is long-term, and the investment strategy has been designed to withstand bad market surprises.

He credits Martin with bringing a well-defined strategy developed through her experience at Yale, one that has served Wesleyan extremely well.

“Running an investment office in Middletown is not the easiest task,” he says. “We’re not in an urban center and much of the time staff are on the road visiting managers. You have to have a good network of people you can talk to for ideas and advice. She has brought that culture to Middletown. She has a team that works very collegially, intellectually challenges one another, and represents what you would want to find in an investment office of a liberal arts institution. She looks for people to challenge her and put new ideas into the mix.”

Daily implementation of strategy falls to Martin and her team, consisting of five professionals with varied backgrounds but unified by a passion for investing, a strong work ethic, and a team mentality.

“Investing requires research, curiosity, relationship building, and judgment,” Martin says. “We like adding people who bring something fresh to the discussion.

“The team works as a team; we don’t silo people off into managing asset classes. We believe that a second opinion is important in everything we do, so each investment is discussed by the group as a whole.”

Resnick says that Martin has another quality, which he values highly.

“She lives and breathes Wesleyan. It’s great when you have someone who has the same feeling for the institution that an alum has.”